www.MilestoneApply.com gives you the opportunity to respond to their Mail Offer online and get yourself approved for the best cards offered by Milestone. Simply enter the Personal Code (from your letter) and Zip code to get started.

Milestone® Gold Mastercard® is the best option for those with a bad credit score. You can apply for the Milestone credit card to rebuild your credit. Usually, the card will be approved for those with a credit score below 640, who don’t want to put down a deposit.

Recommended FICO® ScoreΘ Rating

Poor – Good, New to Credit, Rebuilding

RECOMMENDATION: The focus should always be on timely payments of all your debts and loans. In addition to that, the best practice for improving your credit score is to keep your credit utilization rate low. That means using as little of your available credit as possible. This may be a tough task when your credit limit is low, but to increase your credit score, this should be on top of the list in addition to timely payments

Contents

Milestone Card Highlights

Milestone is a basic credit card you can use for building credit or new credit.

Card Details

- Milestone Card reports to all three credit bureaus (TransUnion, Equifax, and Experian) in US.

- The pre-qualification process and will not impact your credit score.

- Online banking access at any time.

- No perfect credit, no problem.

- All credit histories considered.

- Disclaimers: *Dependent on credit worthiness.

- FCBA and EFTA offer protection from fraud if your card is stolen.

Milestone Credit Card’s Key APRs & Fees

| One-time fees | $0 |

| Monthly fee | 0$ |

| Intro APR | N/A* |

| Ongoing APR | 24.90% |

| Annual fee | $35 – $99* |

| Grace period | 25 days |

| Rewards | N/A |

Additional Card Details

| Max Late fee | $40 |

| MAX OVER LIMIT FEE | $40 |

| MAX PENALTY APR | 29.9% |

| FOREIGN TRANSACTION FEE | 1% |

| SMART CHIP | NO |

| CASH ADVANCE APR | 29.9% |

| CASH ADVANCE FEE | 1st year 0%, either $5 or 5% after |

Milestone Master Card Pros & Cons

| Pros | Cons |

|---|---|

| Prequalify it will not impact your credit score | Annual fee |

| No security deposit needed | |

| Custom card design |

Visit www.MilestoneApply.com To Apply For Milestone Card

It’s quite easy to apply for Milestone MasterCard using the personal code. Visit the official website www.MilestoneApply.com and provide the information below:

- Enter your Personal Code

- Enter your ZIP Code

- Click on the Get Started blue button

Note: When you provide all the information mentioned above required in the Mail Offer, be prepared to provide your personal information including your monthly salary (if you’re a salaried person), mortgage payment, nationality, permanent address, etc.

Instant Decision: After submitting the application form, the instant decision takes a minute or so to inform you that you’re eligible or not for the Milestone Mastercard. If you’ve been approved for Milestone Mastercard you’ll receive a credit limit and your new Milestone Mastercard mailed to your address.

How to find your Milestone personal code?

Let’s find your Milestone personal code!

You received a Mail Offer from Milestone in your mail; open your offer letter, 12-digit personal code should be mentioned at the top or at the bottom of the letter.

What if you lost your mail offer letter?

Did you lose your mail offer letter? You don’t have to worry; we’re here to help you with this problem.

If you lost your personal code letter you have to follow these steps to find your Milestone personal code:

- Open this link Milestone Apply

- Click on the apply now button

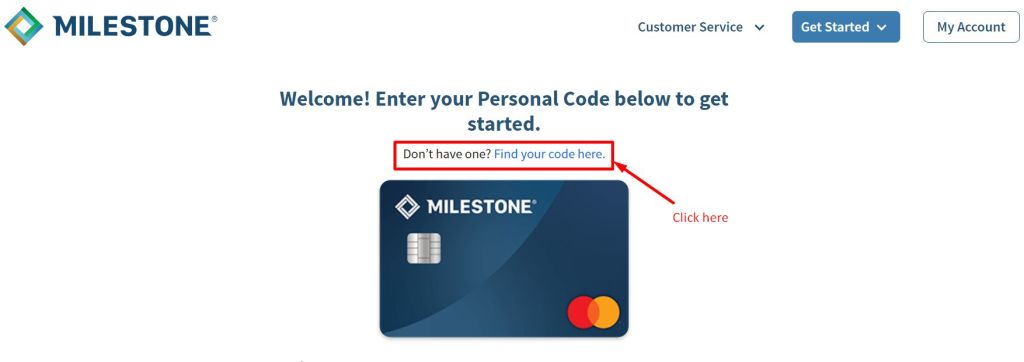

- Click on the link as shown in the picture below

Enter the following details on the application form:

- First Name

- Last Name

- Date of birth (MM/DD/YYYY)

- Last 4 digits of SSN (Social Security Number)

- Zip Code

- Click on the Find Offer blue button

Didn’t receive Milestone Mail Offer?

No worries! Opt for their pre-qualified for a personal credit card form instead. Users who wish to apply for a Milestone MasterCard but have not received an invitation in the Mail can still apply.

Visit Milestoneapply.com and click on “See if you’re pre-qualified for a personal credit card!”. This will direct you to a form that will ask you to fill out.

- Name

- Address

- Phone Number

- Date of Birth (MM/DD/YYYY)

- Social Security Number (SSN)

- Click the blue Pre-Qualify Now button

After submitting your Prequalify application for the credit, you need to wait for the approval. If you are lucky enough to have your application approved, you will receive the card within 14 business days.

If you do not receive the Milestone Mastercard within 14 business days, we recommend you wait for another one before contacting us at +1-866-453-2636.

Milestone® Gold Mastercard® review: A great initiative to help people build credit and improve financial health

Milestone® Gold Mastercard® has many great features that are great for individuals with Bad Credit and/or no credit at all. This card is ideal for people who have recently been in a financial downturn like bankruptcy or inability to pay off loans. This card is also great for young adults who are starting out their credit journey as they look for their first credit card and have no prior credit history.

Whether you have bad credit or no credit history at all, Milestone® Gold Mastercard® assists in building credit history with its credit card program. The card is an unsecured credit card, which means there is no security deposit required. For individuals who are in a bad financial position, putting down a security deposit is a major obstacle. Milestone® makes it possible for you to apply for credit.

Milestone® also reports to all the major credit bureaus. This means that as you spend and repay your credit card responsibly every month, you will be able to see an instant improvement in your credit scores.

Because you may have a poor credit score, you cannot afford to apply for a credit card and have it impact your credit score with a hard inquiry. Milestone® lets you apply for the credit card program, and they do a soft inquiry. This has no effect on your credit score but instead helps you in determining if you will be approved for the credit card program before you formally apply.

| Milestone Gold Mastercard® | FIT Mastercard® | Applied Bank® Unsecured Classic Visa® Card | First Digital Mastercard® | |

|---|---|---|---|---|

| Regular APR | 24.9% | 29.99% | 29.99% | 35.99% |

| Late Payment | N/A | $41 | Up to $38 | $75.00 for the first year. After that, $48.00 annually. |

| Return Payment Fee | N/A | $41 | Up to $38 | $40 |

| Annual Fee | $35-$99 | See Terms* | See the website for Details* | $40 |

| Activation Fee | N/A | N/A | N/A | $95.00 (one-time fee) |

| Credit Recommended | Bad/Fair/Good | Fair/Poor/Bad | Poor/Bad | Poor/Bad |

The cards mentioned above are major competitors of Milestone® Gold Mastercard®. Looking at the stats above we can see that Milestone® really provides the benefits that are in favor of the client. Keeping you in mind, and truly assisting in rebuilding your credit, this credit card program is amazing.

This program has a lower interest rate than standard credit card programs in its class. If you compare Milestone® to other cards in class, Milestone® ranks better in the interest rates, annual fees, return payment fees, activation fees, and Late payment fees.

This card is meant for individuals who are looking to build/rebuild their credit.

Milestone Mastercard Reviews

Here’s what different users have to say about the Milestone Gold Mastercard and how their experience was when they applied for Milestone.

Experian.com

Rating: Good

4/5

Customer Reviews:

“This card has helped me to get re-established.” By J Green

“I had a good experience getting the card and it is easy to keep up with.

Bottom Line Yes, I would recommend to a friend” By S

“It was easy to apply and I didn’t have to wait very long to get the card. Thanks for recommending Milestone.

Bottom Line Yes, I would recommend to a friend.” By Auradora

WalletHub

Rating: Good

3.5 / 5 from 4,365 reviews

Milestone Credit Card Customer Support

Phone: Just call (866) 453-2636

Fax: You can send documents to (888) 325-4717

Mail: You can send inquiries via mail at the correspondence address:

Genesis FS Card Services

PO Box 4477

Beaverton, OR 97076-4477

Final Words

If you’re looking for an option to rebuild credit standing from a poor credit score, we suggest you apply for Milestone® Gold Mastercard® today! The card can show your financially responsible behavior to all three credit bureaus (TransUnion, Equifax, and Experian) at the cost of a hefty annual fee.

Your request is very unlikely to be rejected. However, we still cannot guarantee 100% approval.

Milestone card comes with an annual fee and a high-interest rate, but if bad credit history, Milestone might be a great option to rebuild your credit history.

Simply remember a certain thing! Make all the dues on time and in full every month to rebuild decent credit history.

Our Philosophy and Methodology: “The right choice for you!”

Milestoneapply.cards conduct its research through an independent credit card research team that provides you with detailed information regarding the credit card. We focus on outlining the overall value of the card, reviews based on star ratings, as well as suitability for the right consumers based on the credit score.

Our financial analysts take a deep dive into the entire key factors that are crucial for deciding when applying for a credit card such as:

- Annual fees and other service fees,

- Security deposits (both the minimum required and maximum allowed)

- Interest rates (APR)

- Free credit score check, other credit education, or a requirement of a credit score to apply

- Reporting to credit bureaus

- And potential rewards program.

Frequently Asked Questions

Is Milestone a real credit card?

It’s a credit card for persons with little or no credit history, as well as those with some credit issues. You can utilize it to establish credit if you’re careful with how much you charge and make sure to pay your bills on time and in full.

Does Milestone do a hard pull?

Yes, a hard pull will be performed by the Milestone Credit Card. Even if you have bad credit, you can apply for it.

Is there an app for Milestone MasterCard?

Most competitors have both a mobile app and 24/7 customer assistance, but Milestone Mastercard does not.

What is Milestone Gold Card?

The Milestone® Gold Mastercard® is an unsecured credit card and one of the best cards which require no security deposit and helps you build your credit. It is designed for people with bad credit or no credit history.

How to pre-qualify for a Milestone Credit Card?

The online Milestone Credit Card website allows you to pre-qualify for Milestone Card and Build your credit. Fill up your contact information, date of birth, and Social Security Number on the online form. Then click the “Accept” button which means you have read and agreed to the privacy policy. And at the bottom of the page, click the “Pre-Qualify Now” button. After submitting the pre-qualification form, you will receive an email. You will see a mail offer to apply Milestone Credit Card which means you are pre-qualified.

What if not pre-qualify for Milestone Credit Card?

After submitting the online pre-qualification form, you will receive an email from Milestone. If you won’t pre-qualify for Milestone Credit Card, Milestone also sends you an email with offers to apply for its partner banks’ credit cards. Milestone will not let you live without a credit card.

What is the credit limit on a Milestone Gold Credit Card? Can I increase it?

It has a $300 minimum credit limit and an annual charge of up to $99. Your initial credit limit will be $300 if you are approved for a Milestone Gold Mastercard. Some issuers may automatically increase your credit limit if you use your credit responsibly over time, while others will increase your credit limit if you request it. The $300 credit limit on this card, on the other hand, is standard; you cannot request an increase.

How long does it take to get a Milestone Card?

After you’ve been authorized, you should receive your new Milestone Credit Card within 14 business days.

How do I activate my Milestone Credit Card?

By entering into your online account, clicking the “Activate Your Card” link, and following the procedures, you can activate your Milestone Credit Card. You can register for an online account from the login page if you haven’t already.

How to contact Milestone Credit Card customer support?

You can get in touch with customer service at 1-866-453-2636. (from 6:00am to 6:00pm, Pacific Time, M-F).

How to check Milestone Credit Card application status?

You can check the status of your Milestone Credit Card application by calling (866) 502-6439 and using the automated system, which is available 24 hours a day, 7 days a week.

Does Milestone Credit Card have rewards for its customers?

On the secure site of the Bank of Missouri, one of the many things that lenders check while evaluating your application is your credit score. There is no rewards program with this Milestone card.

Can I use Milestone Credit Card at ATM?

If you have your cash advance PIN, you can acquire a Milestone credit card cash advance at any ATM. You can receive a PIN by contacting 800-958-2556 if you don’t have one. Despite the fact that the Milestone credit card offers a 0% cash advance fee for the first year, the cash advance APR is 29.9% and accrues right away.

How do I pay for my Milestone Credit Card online?

To make a payment online or modify your account, simply login to your Milestone Credit Card online account. To make a payment by phone, call Milestone Credit Card customer care at (866) 453-2636 and follow the directions.

Why can’t I log into my Milestone account?

Follow these steps to get started: Check to see if the Milestone Service Control service is running. Make sure that all Milestone Services is configured to use a local/domain administrator account to log in. Check to see if a Local Administrator has tried to log in using Windows authentication (the current user).

What bank is behind Milestone Credit Card?

The Bank of Missouri owns Milestone Credit Card.

Miriam Caldwell has been working as a freelance writer about budgeting and personal finance basics since 2005. Caldwell’s work has been published by GOBankingRates, The Balance, and BlissfullyDomestic.com. She teaches writing as an online instructor with Brigham Young University-Idaho and is also a teacher for public school students in Cary, North Carolina.